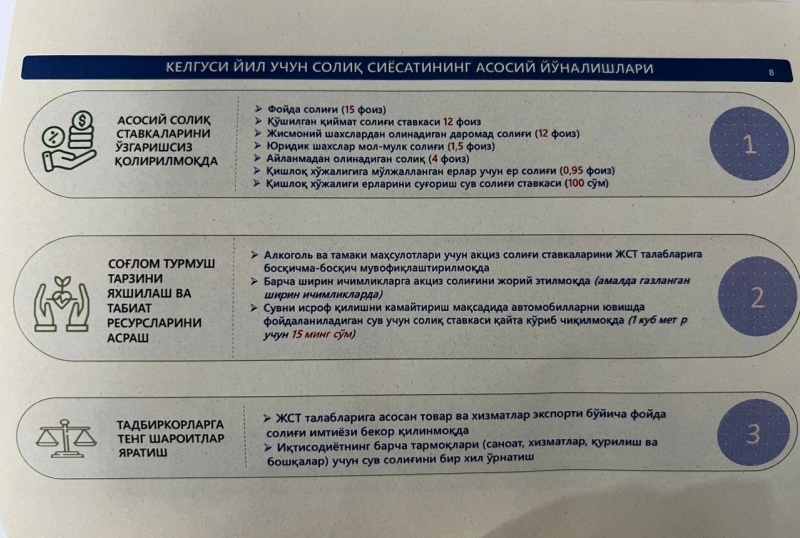

No increase in main Taxes for Uzbekistan in 2024

Local

−

01 November 2024 6524 2 minutes

The main tax rates in Uzbekistan will remain unchanged through the end of 2024, according to Mubin Mirzayev, First Deputy Chairman of the Tax Committee.

The tax rates to be maintained include most major categories.

However, to curb water wastage, the tax rate for water used in car washes will be adjusted. Consumers will now pay 15,000 soums per cubic meter of water used for car washing, up from the previous rate of 2,410 soums. To ensure equal conditions across industries, this new water tax rate will apply to all sectors, including industry, services, and construction.

Additionally, an excise tax will be introduced on all soft drinks containing sugar. Previously, this tax applied only to carbonated sweetened beverages.

"In line with World Trade Organization requirements, the tax exemption on profits from the export of goods and services will be revoked," stated a report from the Ministry of Economy and Finance.

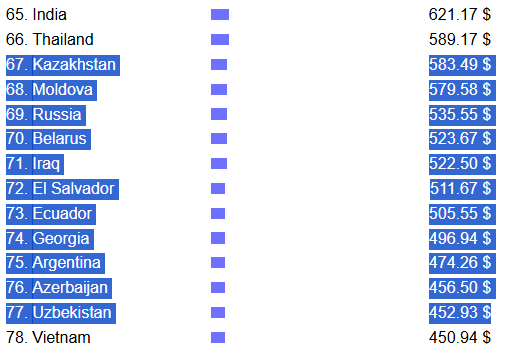

According to Mirzayev, Uzbekistan’s tax burden remains comparatively low in relation to its main trading partners, such as Kazakhstan and Russia.

For context, the average monthly salary in Kazakhstan is over 583 USD, while in Russia, it is 535 USD. In Uzbekistan, the average salary is reported at 452 USD in international rankings.

Earlier, we published a video discussing Uzbekistan's budget deficit and rising external debt.

Live

All