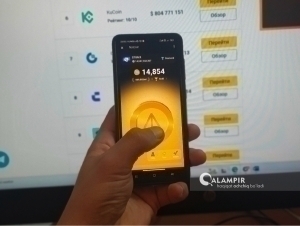

Trading with cryptocurrencies such as Bitcoin and Notcoin is forbidden — Fatwa Center

Local

−

03 June 2024 15977 3 minutes

Trading in Bitcoin, Notcoin, and other similar cryptocurrencies is deemed impermissible in Islam, according to a statement from the Fatwa Center of the Office of Muslims of Uzbekistan.

“Cryptocurrency refers to a digital or virtual currency that relies on cryptography to secure transactions and manage the creation of new units. Unlike traditional currencies, cryptocurrencies are decentralized and are not regulated by a central authority such as a bank or government.

Under Shariah law, trading in cryptocurrencies is not permissible because these digital currencies do not meet the necessary criteria established for money. Their lack of official recognition by any country, the sharp fluctuations in their value, and their resemblance to gambling activities render them haram (forbidden),” the report stated.

Islamic rules stipulate that real money is gold and silver, with other coins serving as their substitutes. These substitutes, including electronic forms, must meet specific conditions to be considered valid money.

Non-cash cryptocurrencies, also known as "Digital Money" or "Virtual Money," fail to meet the following essential requirements for money and pose certain risks:

1. Lack of essential characteristics of money:

According to Islamic jurisprudence, money must be gold, silver, or a substitute that has intrinsic value, is officially recognized and guaranteed by the government, and is used as a medium of exchange (Al-Mawsuatul Fiqhiyya Al-Kuwaytiyya).

Cryptocurrencies do not satisfy these conditions and therefore cannot be considered valid money for exchange or trade.

2. Issuance by the State:

Islamic law states that issuing money is a sovereign right of the state. None of the popular cryptocurrencies have been officially issued by any country, and their creators are often anonymous. The renowned scholar Ibn Khaldun emphasized:

“Minting money is a royal prerogative to ensure authenticity and value in transactions (Muqaddimah, p. 261).”

3. Universal acceptance:

For a currency to be valid, it must be universally accepted and usable by everyone. Currently, cryptocurrencies are only accessible to those within certain systems and are not widely accepted in transactions, rendering them incomplete as money.

4. Uncertainty of outcome:

The future of cryptocurrencies is highly uncertain with no guarantees of stability or permanence. Their lack of backing by a stable reserve makes their value unpredictable and risky, which Islam prohibits as it equates to wasting wealth.

5. Volatile value:

The extreme volatility in cryptocurrency values, and the speculative nature of trading them, resembles gambling. Most traders aim to profit from price fluctuations rather than using the currency for its intended purpose. Islam prohibits gambling and similar speculative activities.

6. Potential for fraud:

The anonymity of cryptocurrency ownership and the absence of intermediary regulation facilitate illegal activities such as money laundering and fraud. The irretrievability of funds once transferred adds to the risk.

Given these factors, international fatwa councils and Islamic jurisprudence academies have thoroughly examined the issue of cryptocurrencies and concluded that trading in them is not permissible.

Live

All