Uzbekistan's rising budget deficit and external debt

Review

−

31 October 2024 14838 2 minutes

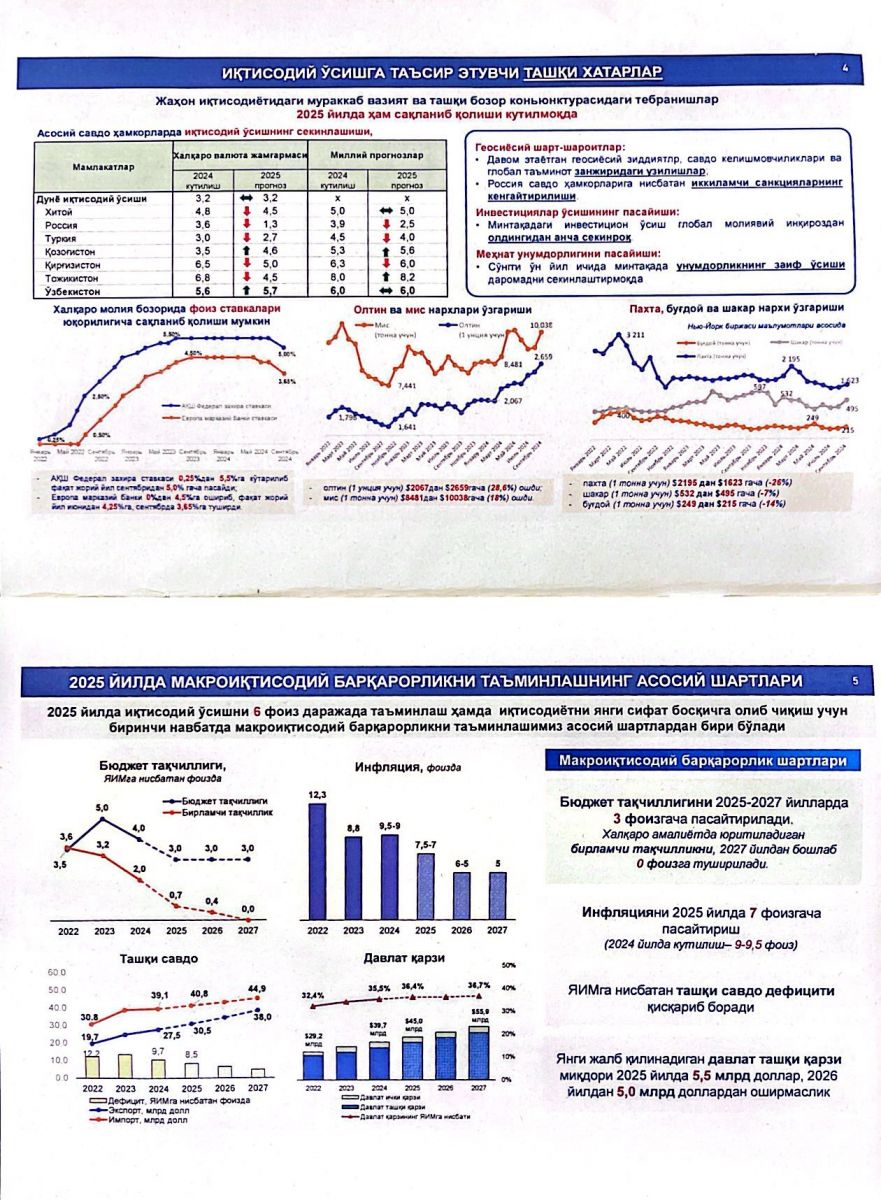

Uzbekistan’s budget deficit has been increasing significantly in recent months. From January to March, budget spending surpassed revenue by 17.7 trillion soums—a 6 trillion soum rise over last year’s figures.

By the third quarter, the deficit had surged to 37.3 trillion soums, with projections suggesting it may reach 55 trillion soums by year-end. This raises questions about what is driving the deficit and how the government plans to address it.

At a recent press conference, Deputy Minister Ahadbek Haydarov acknowledged the deficit but expressed optimism, aiming to reduce it from 55 trillion to 49.3 trillion soums by 2025. However, past projections have consistently fallen short, with the 2023 deficit exceeding targets by 27 trillion soums. The government’s solution often relies on external debt, which has led to a threefold increase since 2017, reaching $37 billion as of mid-2024. The Ministry aims to keep public debt below 60% of GDP, though projections estimate external debt could reach $45 billion by 2025.

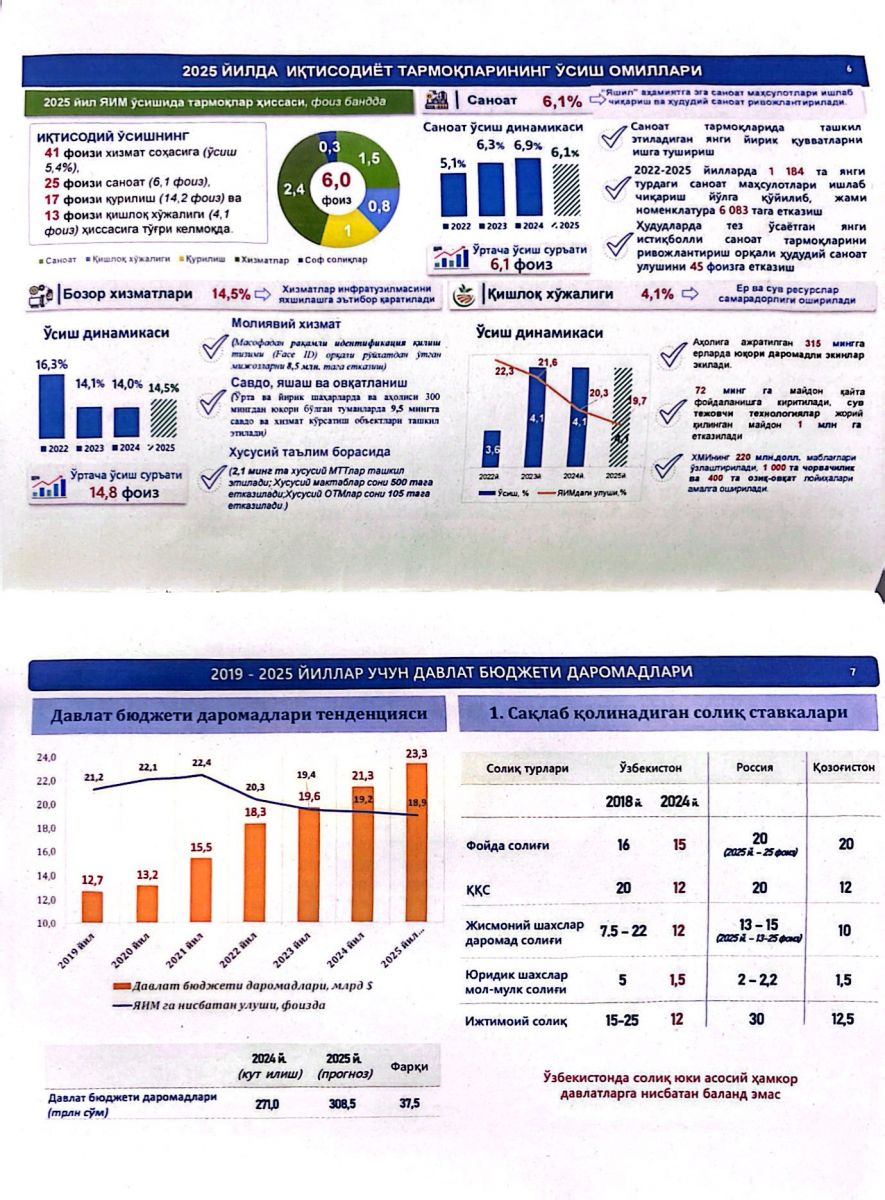

Inflation and Tax Adjustments

In 2024, inflation is expected to climb to around 9%, to reduce it to 7% by 2025. Tax compliance issues also impact revenue, with tax evasion by citizens and businesses contributing to the shortfall. Although no major tax increases are planned for 2025, the government will review water usage taxes to discourage wastage, with costs for vehicle washing likely to rise.

Economic Growth and Geopolitical Risks

Despite the challenges, Uzbekistan's economy is projected to grow, with the IMF estimating a 5.7% increase in 2025. However, external risks—such as geopolitical tensions and declining productivity—pose additional threats. With reduced investment inflows, Uzbekistan faces added pressure on both economic stability and growth potential.

The Ministry of Finance and Economy continues to highlight economic expansion, yet questions remain about the long-term sustainability of current fiscal policies amid mounting debt and global uncertainties.

Live

All